Open Source Code

View the complete implementation code on GitHub. Provides example code and simulation code for each chapter.

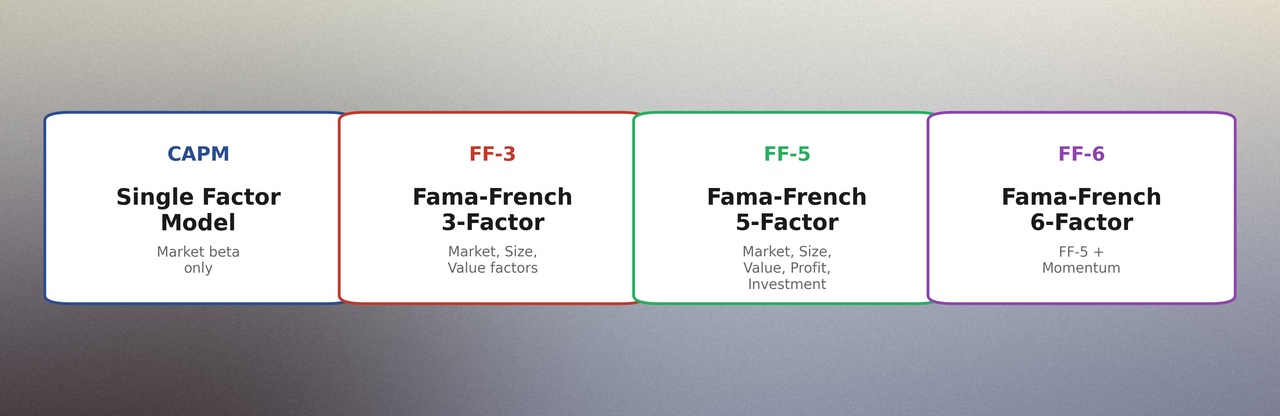

From CAPM limitations to Fama-French multi-factor models and practical portfolio construction

Section 5 covers the theoretical foundations and practical applications of factor-based asset pricing models, with a focus on the Fama-French models. You will learn how CAPM's limitations led to the development of multi-factor models, understand the theoretical background of Fama-French models, and implement practical factor-based investment strategies.

The Capital Asset Pricing Model assumes market beta is the only source of systematic risk. However, empirical evidence shows that market anomalies like size and value effects cannot be explained by market beta alone, leading to the development of multi-factor models.

Fama-French models add additional risk factors beyond market beta: SMB (Small Minus Big) for size risk, HML (High Minus Low) for value risk, and additional factors for profitability and investment in extended models. These factors represent systematic risks that investors require compensation for.

Factor-based portfolios are constructed by selecting stocks with desired factor exposures. This approach allows investors to target specific risk-return profiles and implement systematic investment strategies based on factor models.

View the complete implementation code on GitHub. Provides example code and simulation code for each chapter.

Learn the theoretical background and detailed implementation process step by step. Covers from mathematical background of each model to Python implementation.