GitHub Repository

View the complete source code on GitHub. Open source and community contributions are welcome.

This project implements a production-level investment strategy using a hybrid model that combines VECM (Vector Error Correction Model) and EGARCH (Exponential GARCH). Beyond simple backtesting, it simulates real trading environments and achieves more accurate predictions and risk management through confidence-based position sizing and dynamic reoptimization strategies.

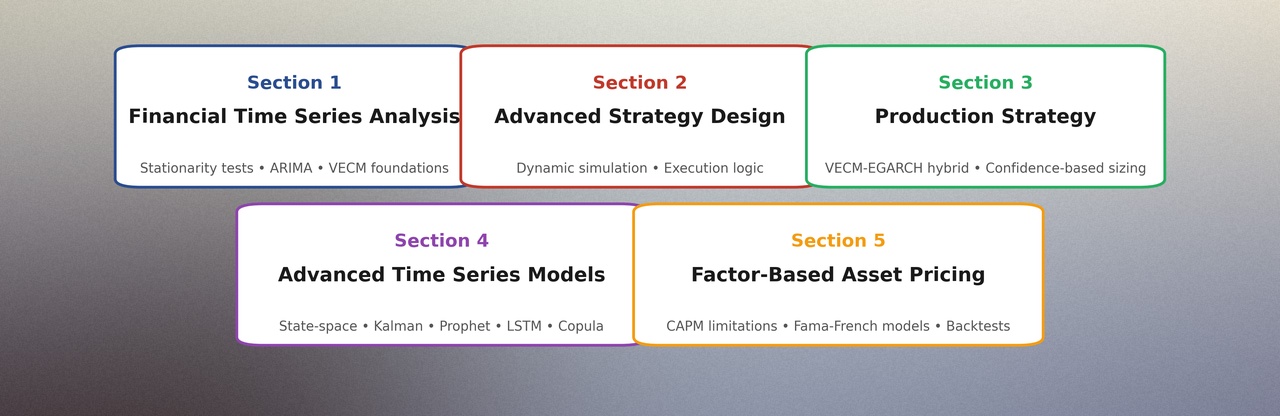

| Section | Content |

|---|---|

| Section 1 | Financial Time Series Analysis - From fundamentals to advanced models in time series analysis |

| Section 2 | Advanced Investment Strategy Design - Practical investment strategy design and implementation |

| Section 3 | Production Investment Strategy - Production-level trading simulation |

| Section 4 | Advanced Time Series Models - State-space, Kalman, Prophet, LSTM, tree-based ML, wavelet, and copula strategies with walk-forward engineering |

| Section 5 | Factor-Based Asset Pricing Models - From CAPM limitations to Fama-French multi-factor models and practical portfolio construction |

View the complete source code on GitHub. Open source and community contributions are welcome.

Learn the theoretical background and detailed implementation process step by step. A comprehensive course including practical examples and advanced techniques.

This project is provided for educational and research purposes. The project author is not responsible for any losses that may occur when using this for actual investment. Please invest at your own discretion and responsibility.