Section 1: Financial Time Series Analysis

From fundamentals to advanced models in univariate and multivariate time series analysis. Covers theory and implementation of ARIMA, GARCH, and VECM models.

From fundamentals to advanced models in univariate and multivariate time series analysis. Covers theory and implementation of ARIMA, GARCH, and VECM models.

Learn practical investment strategy design methodologies including dynamic time series simulation, Bitcoin trading strategies, and Binance AI trading.

Production-level trading simulation using VECM-EGARCH hybrid model. Confidence-based position sizing and dynamic reoptimization strategies.

State-space, Kalman, Prophet, LSTM, tree-based ML, wavelet, and copula pipelines with walk-forward retraining and leakage-safe signals.

From CAPM limitations to Fama-French multi-factor models, alpha/GRS tests, and factor-tilted portfolio construction with walk-forward backtests.

View actual trading history generated through simulation. Provides performance metrics, charts, and detailed trading history.

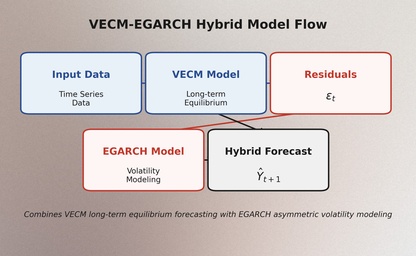

A hybrid approach combining long-term equilibrium forecasting using cointegration relationships with asymmetric volatility modeling. Production-level implementation applicable to real trading.

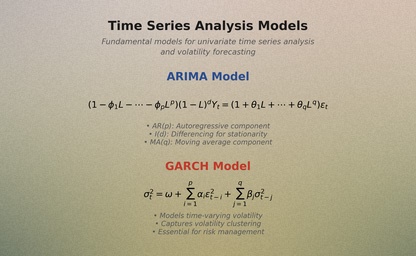

Theoretical background and Python implementation of ARIMA, GARCH, and VECM models. Covers key concepts including stationarity testing, cointegration analysis, and volatility forecasting.

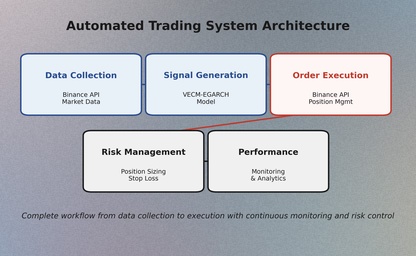

Learn how to build automated trading systems using dynamic simulation, Bitcoin trading strategies, and Binance API.

View actual trading history and performance metrics generated through simulation. Provides total P&L, win rate, Sharpe ratio, maximum drawdown, and more.

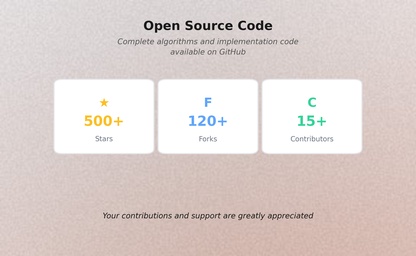

View the complete algorithms and implementation code on GitHub. Open source and community contributions are welcome.

Learn the theoretical background and detailed implementation process step by step. A comprehensive course including practical examples and advanced techniques.